Invest with Cochin Gold & Diamonds – Secure Returns, Trusted Legacy

Since 1987, Cochin Gold & Diamonds has been a name synonymous with purity, craftsmanship, and trust. Today, we invite global investors to be part of our expanding journey across the GCC and international markets — backed by the enduring strength of gold and diamonds.

Join Our Investor Network

Earn 12% annual returns with Cochin Gold & Diamonds’ growth-focused investor program. Powered by our retail jewellery and manufacturing expansion, this plan ensures consistent profit sharing across our business operations. With transparent reporting, scheduled payouts, and long-term trust, your investment works alongside us to build sustainable wealth.

Global Presence & Ambitious Vision

Currently, Cochin Gold & Diamonds proudly operates three luxury showrooms across Oman, including key locations in Muscat, Sohar, and the prestigious Oman Avenues Mall. Our dedicated team of over 40 skilled professionals ensures excellence in retail and manufacturing.

Our ambitious expansion plans include establishing eight new showrooms within Oman and strategically entering the lucrative GCC markets. This growth is driven by our core values of trust, innovation, and customer-centricity, delivering unique, high-quality designs at fair prices through in-house manufacturing.

Our Enduring Legacy

Tracing our roots to a commitment to excellence, Cochin Gold & Diamonds stands on decades of experience in the precious metals sector, building a foundation of trust and reliability.

1987 by Mr. Jagajith Prabhakaran (Founder & Managing Director)

Assarain Jewellery LLC (est. 1993, Sultanate of Oman)

2015 – Cochin Gold & Diamonds

3 luxury Showrooms across Oman (Ruwi Highstreet, Oman Avenues Mall, Sohar Souq)

40+ skilled professionals across retail & manufacturing

8 new showrooms in Oman, plus entry into GCC markets

Guaranteed return on gold investment

Flexible payout: Monthly / Quarterly / Half-Yearly / Yearly / Retention Minimum recommended tenure: 3 years Capital growth potential through gold value appreciation.

Guaranteed return on business investment

Earn 12% annual returns through our business-wide investment program, driven by retail jewellery and manufacturing growth. Enjoy scheduled payouts with transparent reporting and profit sharing.

Why Invest: Unwavering Returns

Cochin Gold & Diamonds offers unparalleled financial benefits, providing investors with robust security and predictable income streams within a thriving market.

Guaranteed return on business investment

Investment applied across our business operations for growth & profit sharing Focused on retail jewellery and manufacturing expansion Returns distributed per agreed schedule Transparent reporting and periodic statements

Yearly Returns

| Year | Returns per Annum | Cumulative on Retention |

|---|---|---|

| Year 1 | 12,000.000 | 12,000.000 |

| Year 2 | 12,000.000 | 13,440.000 |

| Year 3 | 12,000.000 | 15,052.800 |

| Year 4 | 12,000.000 | 16,859.136 |

| Year 5 | 12,000.000 | 18,882.232 |

| 60,000.000 | 76,234.168 |

Investment Growth Comparison

| Year | Investment Growth (Yearly Dividend Withdrawal) |

Investment Growth (Cumulative on Retention) |

|---|---|---|

| Year 1 | 112,000.000 | 112,000.000 |

| Year 2 | 124,000.000 | 125,440.000 |

| Year 3 | 136,000.000 | 140,492.800 |

| Year 4 | 148,000.000 | 157,351.936 |

| Year 5 | 160,000.000 | 176,234.168 |

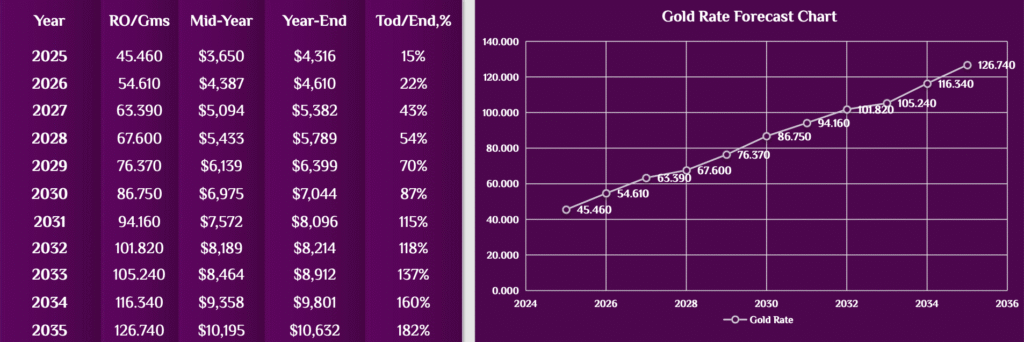

10 Years goldrate forecasting chart

Guaranteed return on gold investment

Flexible payout: Monthly / Quarterly / Half-Yearly / Yearly / Retention Minimum recommended tenure: 3 years Capital growth potential through gold value appreciation.

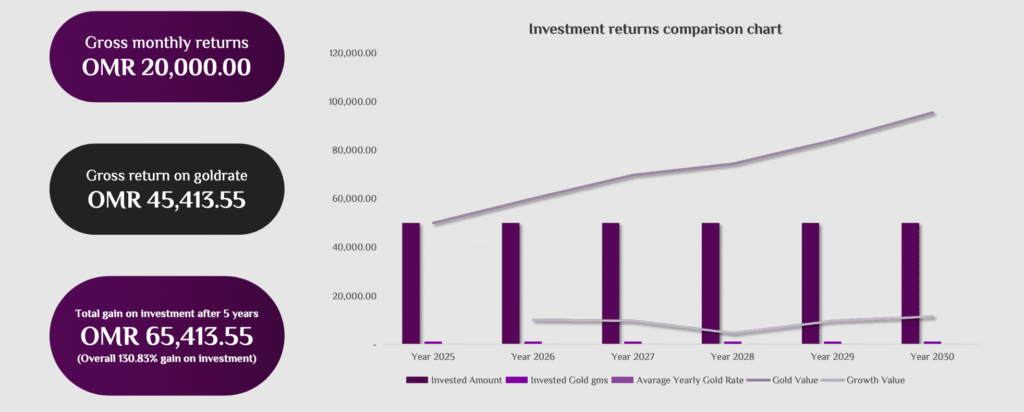

How returns work

Returns can be paid monthly, quarterly, half-yearly, yearly or retained and compounded. Below is an illustrative example for an OMR 50,000 investment at 8% p.a. for 5 years (gold scheme).

| Year | Returns per Annum | Cumulative on Retentation |

|---|---|---|

| 2026 | 4,000.00 | 4,000.00 |

| 2027 | 4,000.00 | 4,320.00 |

| 2028 | 4,000.00 | O4,665.60 |

| 2029 | 4,000.00 | 5,038.85 |

| 2030 | 4,000.00 | 5,441.96 |

| 20,000.00 | 23,466.40 |

Yearly Returns

Projected return on goldrate growth

| Year | Invested Amount | Invested Gold gms | Avg Yearly Gold Rate | Gold Value | Projected Growth Value | & of Growth |

| Year 2025 | 50,000.00 | 1,099.87 | 45.460 | 50,000.00 | ||

| Year 2026 | 50,000.00 | 1,099.87 | 54.610 | 60,063.79 | 10,063.79 | 20.13% |

| Year 2027 | 50,000.00 | 1,099.87 | 63.390 | 69,720.63 | 9,656.84 | 16.08% |

| Year 2028 | 50,000.00 | 1,099.87 | 67.600 | 74,351.08 | 4,630.44 | 6.64% |

| Year 2029 | 50,000.00 | 1,099.87 | 76.370 | 83,996.92 | 9,645.84 | 12.97% |

| Year 2030 | 50,000.00 | 1,099.87 | 86.750 | 95,413.55 | 11,416.63 | 13.59% |

OMR 45,413.55

(90.82% of investment)

Projected return on Investment

Comprehensive Comparison Overview

| Feature | Option 1 (12% p.a. Fixed Return) | Option 2 (8%p.a. + Gold Appreciation) |

|---|---|---|

| Return Rate | 12% p.a. (fixed) | 8% p.a. (guaranteed) + additional return from gold value appreciation |

| Risk Level | Very low (fixed return, no market dependency) | Low (guaranteed base return, but upside dependson gold market) |

| Capital Safety | Investment value protected | Investment value protected (even in market collapse) |

| Flexibility | Flexible tenure & profit withdrawal | Flexible tenure & profit withdrawal |

| Growth Potential | Limited to fixed 12% p.a. | Higher if gold prices rise significantly |

| Handler | Gold retailer | Gold retailer |

Pros & Cons

| Feature | Option 1 (12% p.a. Fixed Return) | Option 2 (8%p.a. + Gold Appreciation) |

| Pros: |

|

|

| Cons: |

|

|

Contact & Apply

Complete this form and our investments team will contact you. Alternatively use the WhatsApp / Call button at bottom-right.